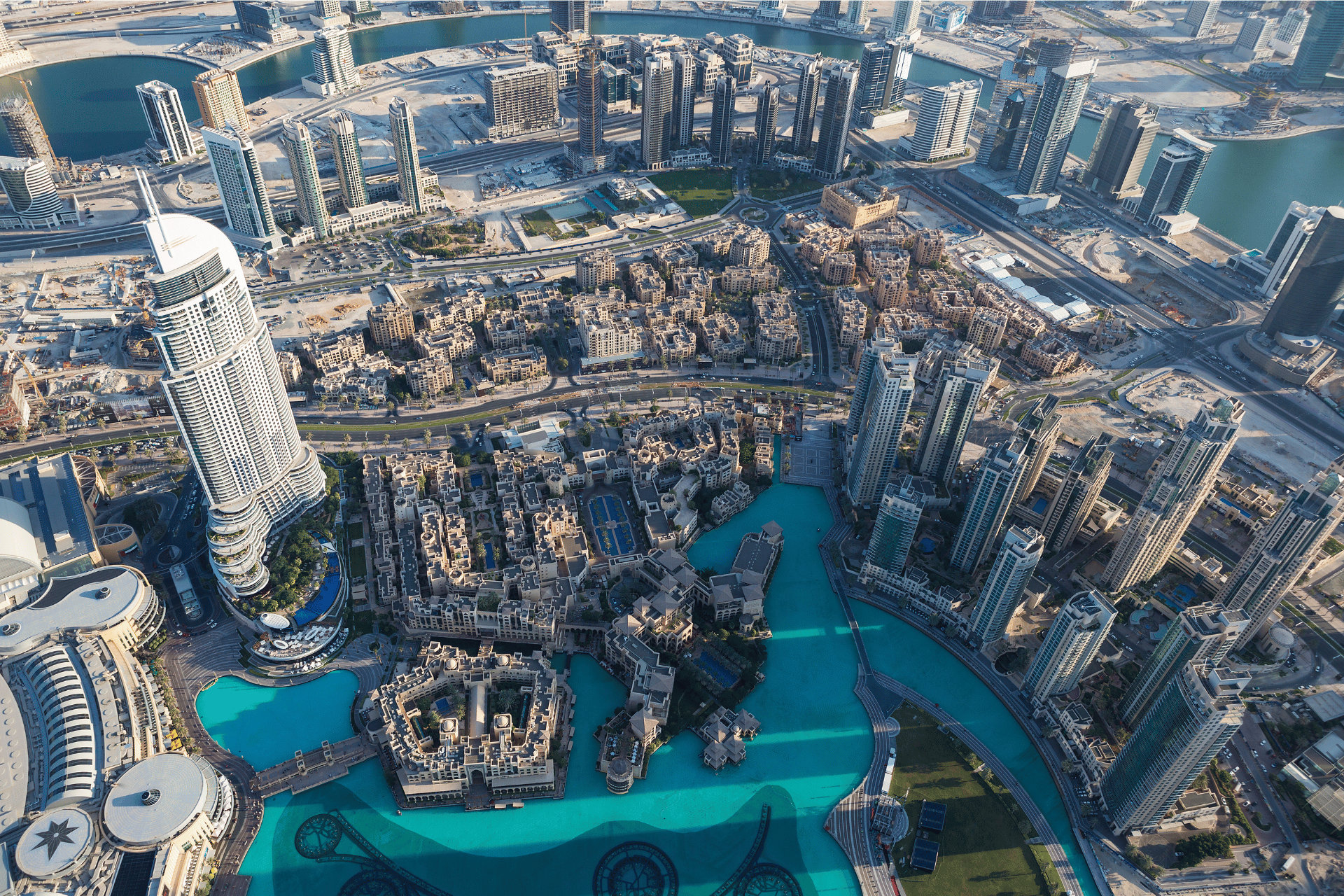

Buy Luxury Property for Sale in Dubai & UAE

Discover the epitome of luxury when you invest in a property in Dubai, where architectural brilliance meets world-class amenities. Each residence combines elegance and comfort, offering stunning views of the city skyline and pristine beaches. Own a piece of Dubai and experience a lifestyle of sophistication and unparalleled beauty.

Discover a premium lifestyle

Parkwood

1, 2 and 3 Bed Apartments01

Start your day with breathtaking open sea views, setting the stage for a tranquil and luxurious lifestyle. Unwind in the evening to the gentle rhythm of the waves at Parkwood—designed for those who appreciate both elegance and comfort.

- AED 1.75 M*

The Acres

3, 4 and 5 Bed Apartments02

The Acres by Meraas is the newest residential masterpiece in Dubailand, offering an exclusive collection of 3, 4, and 5-bedroom standalone villas. This remarkable community reimagines luxury living, blending contemporary elegance with serene natural surroundings to create a harmonious and sophisticated lifestyle.

- AED 5.5 M*

Damac

4 Bedroom Townhouse, 5 Bedroom Townhouse, 6 Bedroom Villa and 7 Bedroom Villa03

Renowned for iconic developments and exceptional craftsmanship, DAMAC Properties blends elegance, innovation, and world-class amenities. With a presence in the UAE, Saudi Arabia, Qatar, and beyond, its portfolio of luxury residential, commercial, and leisure properties sets a global standard for excellence.

- AED 2.3 M*

COVE II, Creek Harbour The Lagoons by Emaar

Resale Property Distress Deal2 Bedroom, 2 Bathroom and 1 Parking

04

Situated in the heart of Dubai Creek Harbour (The Lagoons), The Cove 2 offers a strategic location connecting residents to Dubai's most famous landmarks within minutes. Known for its breathtaking sunset views, this master-planned community provides a vibrant yet serene lifestyle, ideal for those looking to enjoy leisure-filled, waterfront living.

- AED 3.15 M*

Frequently Asked Questions

1. What are the rules for foreign property ownership in Dubai?

Foreign nationals can own

property in designated freehold

zones across Dubai, granting

expatriates

and international buyers full

ownership rights without

leasehold or usufruct

restrictions for up to

99 years.

1. Title deeds are officially

issued by the Dubai Land

Department.

2. There are no age restrictions

on property ownership.

Popular freehold areas in Dubai

include Business Bay, Downtown

Dubai, Discovery Gardens, Palm

Jumeirah, and DIFC. Notably,

Dubai's property acquisition

regulations are considered more

flexible

compared to other emirates in

the UAE.

2. Are there any limitations on the types of properties foreigners can purchase in the UAE?

Foreign nationals can buy

property in the UAE under

specific conditions. Full

ownership rights are

granted in designated freehold

zones, while in other areas,

only leasehold rights over the

property

structure are permitted.

In freehold zones, property

ownership may also make

foreigners eligible for the UAE

Golden Visa.

Dubai offers several freehold

areas where these regulations

apply. It is advisable to

consult legal

and tax professionals, as well

as local authorities, before

making a purchase decision.

3. How does the property purchase process in Dubai differ from other emirates in the UAE?

When purchasing property in

Dubai, understanding the legal

and regulatory framework is

essential. A

key aspect is the property

registration process, which

requires buyers to validate the

property

title deed with the Dubai Land

Department (DLD) before official

registration.

Financial considerations are

also important, including

transfer fees, registration

fees, and service

charges, which vary based on the

property's location and type.

Dubai has specific regulations

for foreign ownership, making it

crucial to be aware of potential

restrictions, mortgage

requirements, and lease

agreements. Staying informed

about property financing

laws ensures a smooth purchasing

process. It is advisable to seek

independent legal and tax advice

before making a decision.

4. What are the main advantages of investing in property in Dubai or the UAE?

Investing in property in Dubai or the UAE offers numerous advantages, including a stable and growing economy, tax benefits with no personal income or capital gains tax, and high rental yields compared to other global cities. The region boasts world-class infrastructure, freehold ownership for foreigners, and diverse property options, from luxury apartments to commercial spaces. As a global business and tourism hub, Dubai attracts a steady flow of expatriates and tenants, enhancing investment potential. Additionally, certain property investments can qualify investors for residency or long-term visas. However, market fluctuations and regulatory changes should be considered, and seeking professional legal and tax advice is recommended.

5. Are there any taxes applicable to owning property in Dubai or the UAE?

Dubai and the UAE offer a tax-friendly environment for property ownership, with no personal income tax, capital gains tax, or wealth tax on real estate. Residential property transactions are generally exempt from VAT, though commercial property rentals may be subject to it. Property owners may need to pay municipal fees based on the property's rental value and service charges for shared community facilities. Additionally, the UAE does not impose inheritance tax. However, tax regulations may change, and international agreements can impact foreign property owners, so consulting legal and tax professionals is recommended.

6. Is it possible to obtain a residence visa through property ownership in Dubai or the UAE?

Real estate investors in the UAE can obtain a residence visa based on property ownership. A property valued at AED 750,000 or more qualifies for a renewable two-year residence permit, allowing the investor to sponsor their spouse and children. For properties worth AED 2 million or more, investors can apply for a renewable 10-year Golden Visa, which also extends sponsorship to their spouse, children, and parents. Even mortgaged properties qualify if the investor provides a bank letter confirming AED 2 million has been paid. This initiative highlights the UAE’s commitment to attracting investors and supporting family residency.

7. What factors should I evaluate when deciding between freehold and leasehold property options?

Freehold Property: In Dubai,

freehold ownership grants

complete control over both the

property and

the land, ensuring long-term

security and flexibility for

modifications. These properties

typically

appreciate in value, making them

solid investments with rental

income potential. However, they

often

come with higher initial costs,

especially in prime locations,

and are only available in

designated

areas. Additionally, owners are

solely responsible for

maintenance and upkeep.

Leasehold Property: Leasehold

ownership allows individuals to

use and occupy a property for a

fixed

duration, usually offering a

more affordable entry point due

to lower upfront costs. Common

in gated

communities, these properties

provide access to amenities and

reduced maintenance

responsibilities.

However, leaseholders have

limited authority over

modifications, may face renewal

costs upon lease

expiration, and typically

experience lower appreciation

potential compared to freehold

properties.

Conclusion: The decision between

freehold and leasehold depends

on your financial goals, budget,

and

lifestyle preferences. Freehold

properties provide full

ownership and long-term

investment benefits

but at a higher cost. Leasehold

properties, on the other hand,

offer affordability, shared

amenities, and reduced

maintenance but come with

limited ownership rights and

appreciation

potential. Please seek

independent advice from legal

and tax professionals and

relevant local

authorities before making any

decision.

Get a Free Consultation

EOI is now open! Join the waitlist for exclusive early premium units and secure your spot. Get a free consultation where our experts will assist you in selecting the perfect option tailored to your needs.

Call UsContact

Address

A108 Adam Street

New York, NY 535022